For example the replacement of a building roof is considered a major repair if it allows the building to be used beyond its normal operating life.

Roof repair accounting treatment.

However it does have to be one that a taxpayer would expect to incur such as a roof repair.

The accounting for financial statements is different than the accounting for tax purposes.

Replacements of the entire roof and all the gutters.

In many cases only a portion of the roofing system is replaced and depending on the facts those costs may be deducted as repairs.

Free delivery with 45 order.

Intent oberman indicated that a taxpayer s intent is an important factor when considering whether a roof repair or replacement is deductible or capitalizable.

However if the painting directly benefits or is incurred as part of a larger project that s a capital.

Or the engine in a forklift is replaced thereby extending the lifespan of the equipment.

If the repair of roof made in partial or in a whole it should be accounted for as a capital expenditure since it affect the life of the certain asset but if the repair is only to filled out the hole of the roof regardless of the amount of expense it must be charge to outright expense.

Wet r dri all season roof patch model 0375 ga 41 99 41 99.

Each year tax professionals who deal with real estate must evaluate the most recent building expenditures and determine which items should be written off as a repair expense or capitalized.

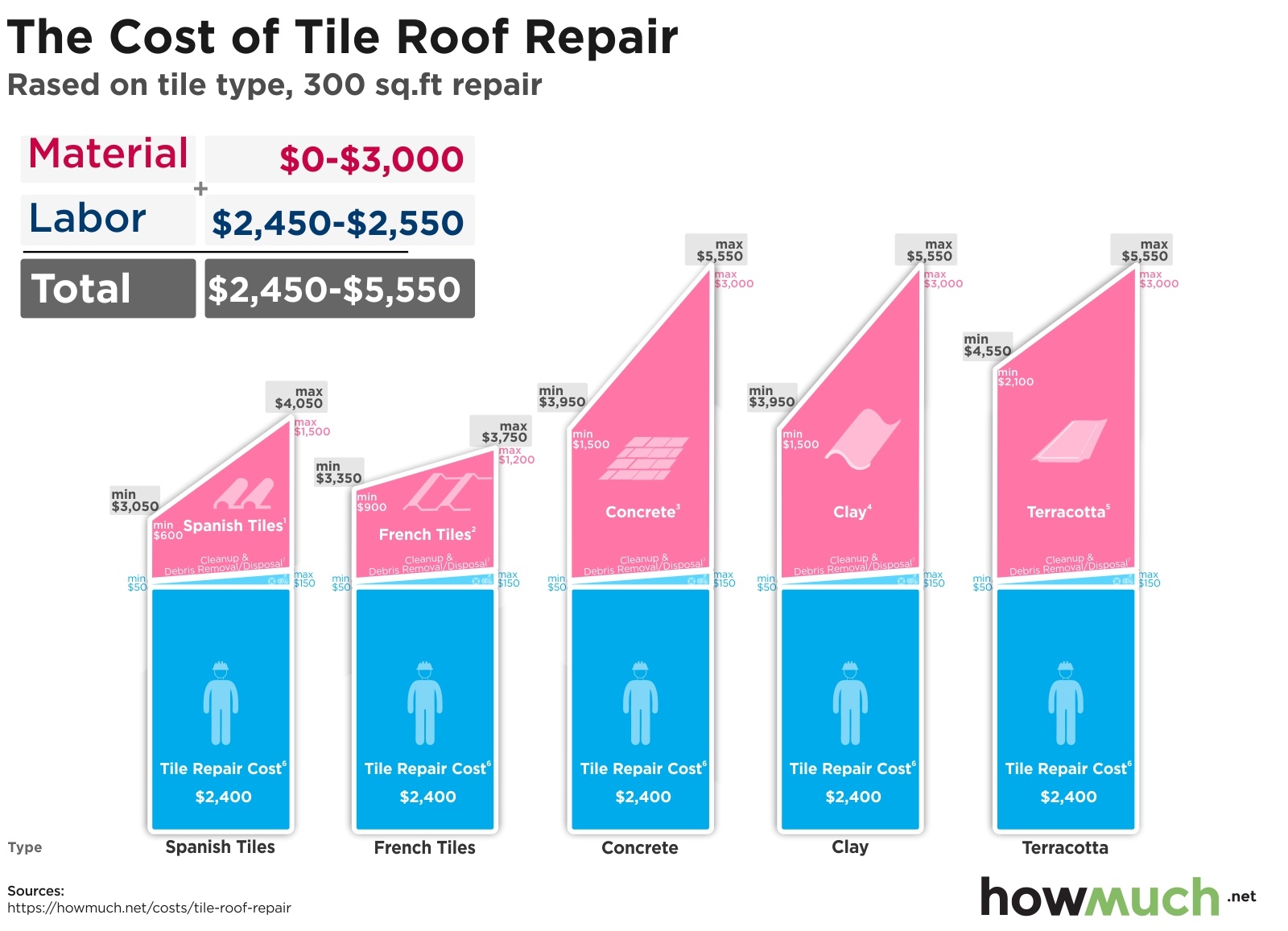

Not all costs to repair replace or enhance a roofing system are created equal so a thorough analysis is the best way to go.

R m expenses are inevitable that is unless the company has an extremely neurotic replacement policy and replaces serviceable equipment instead of fixing.

Sad but true costs related to property plant and equipment pp e don t stop at the purchase point.

885 tropi cool 100 silicone seam and repair roof sealant model he885142 85 26 85 26.

Roofing costs can be substantial and so can be the effect on your tax situation.

In accounting major repairs are capitalized as assets and depreciated over time.

For financial statements the insurance proceeds net of the book value of the roof would be considered a gain for financials and the cost of the roof would be a new asset that gets depreciated.

Set your store to see local availability add to cart.

Having a basic understanding of roof systems and the tangible property regulations can help building owners better evaluate the nature of the work performed.

Thus an expense does not have to be incurred on a regular basis to be ordinary and necessary.

After getting plant assets up and running repair and maintenance r m expenses will eventually follow.

For tax purposes it would be considered a casulty loss and you have three years to reinvest the proceeds.

Having us ask the right questions will go a long way in optimizing favorable tax treatment.

Careful analysis will produce a solid foundation for treating the cost of roofing work as either a repair expense or a capital improvement.